Theme

Guidance on using weADAPT

A collection of FAQs to guide you on using weADAPT.

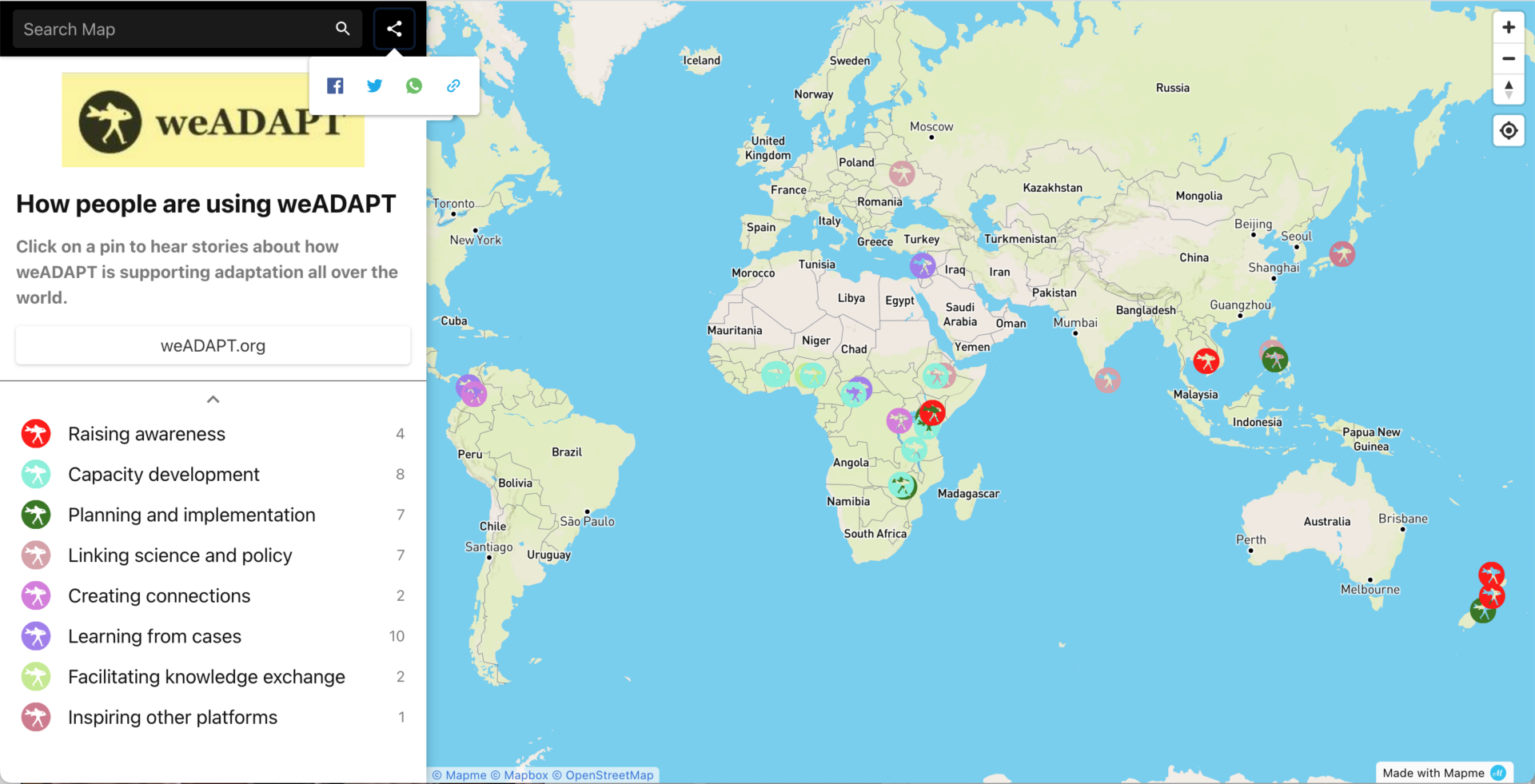

weADAPT at 15: How Research, Policy and Practice Community Members Use the Platform

How has weADAPT's community used the platform during the last 15 years? What impacts have been made? Learn about all of this and more in this article about weADAPT impacts.

SEI Oxford’s 20th and weADAPT’s 15th Anniversary: The Future of Climate Change Adaptation

SEI marked the 20th anniversary of the Oxford Centre and the 15th anniversary of weADAPT with an event that addressed goals for and barriers to adaptation, and ideas to achieve greater progress.

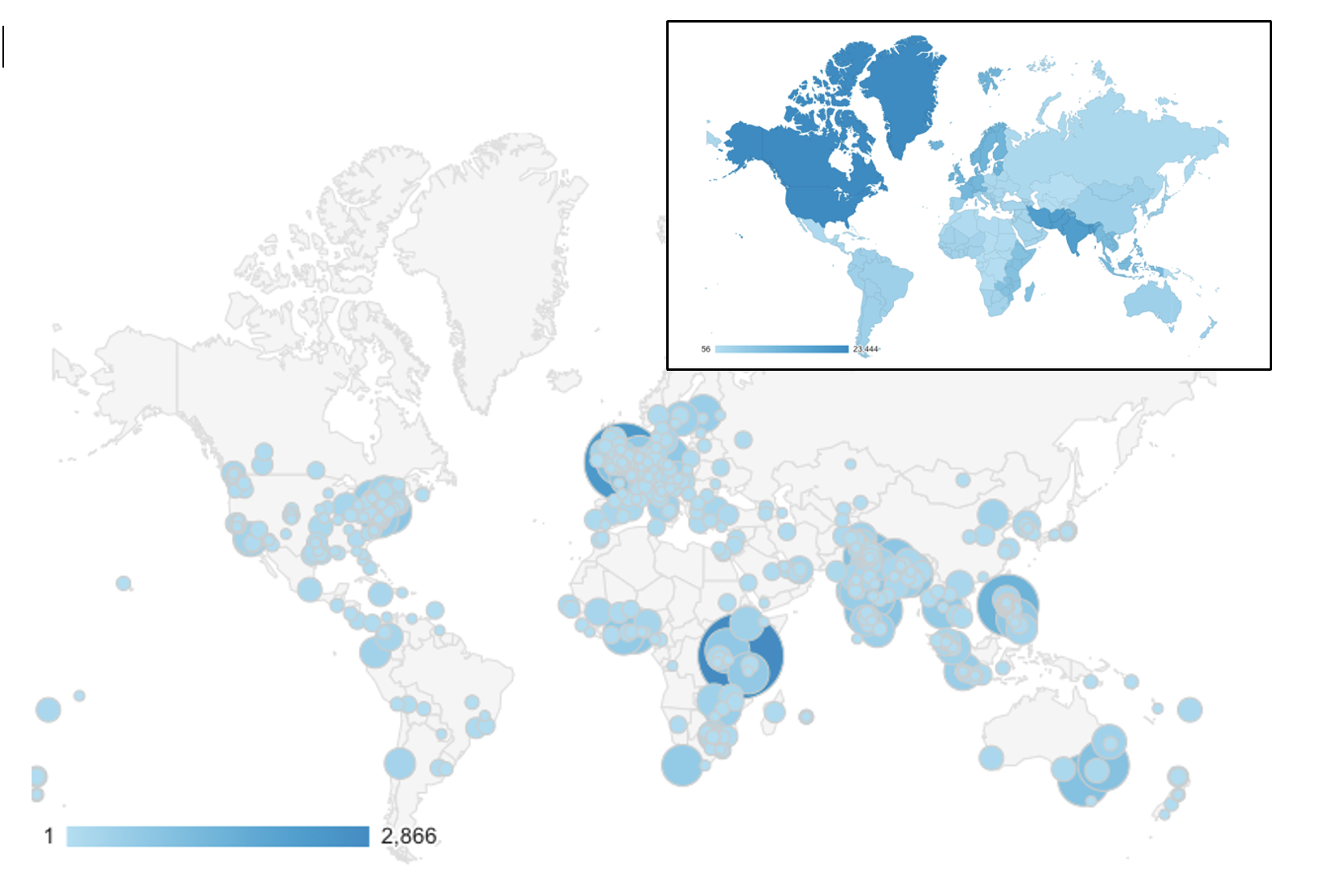

weADAPT Survey 2021 Results – A Brief Insight

Learn about the results of the weADAPT survey 2021 to understand how weADAPT is used and how will be improved in 2022 to meet different user needs.

Share content

Creating or editing an article or case study on weADAPT is now a simple and intuitive process. Learn more how you can share your work on the platform here.

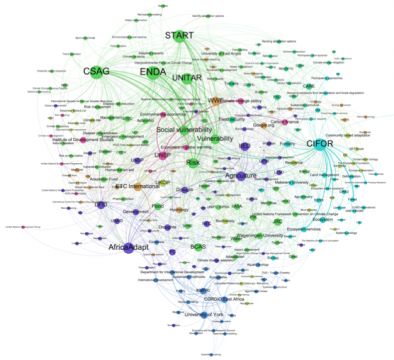

How is weADAPT advancing research on knowledge management?

weADAPT uses innovative technology behind the scenes to link related content together and make it easy to explore and discover new knowledge. Learn more here!

Happy 10th birthday, weADAPT! Celebrating the history and future of the climate adaptation network

This article describes and celebrates the history of the weADAPT climate adaptation network, and shares some glimpses into what we're planning next, and how you can have you say in this!

Services – what you can do on weADAPT!

weADAPT is a collaborative platform on climate adaptation issues. This page describes the services weADAPT currently offers.

weADAPT launches new partner website service

weADAPT is expanding on its mission with the launch of a bespoke website service for projects to better connect, share and build on existing knowledge within the climate change adaptation community.

Putting Climate Knowledge into Climate Action – SEI Oxford seminar 29th of September 2015

On the 29th of September SEI Oxford convened researchers, practitioners, partners and students in an interactive and lively seminar. Please find material from the seminar here

The NEW weADAPT – now at a screen near you!

This article describes the new features of weADAPT.