Plugging The Climate Adaptation Gap With High Resilience Benefit Investments

Introduction

Investment in adaptation can offer cost-effective protection against extreme weather damage, what we refer to as a “resilience benefit.” In particular, demonstrating a strong resilience benefit should attract private investors interested in investments with significant resilience in addition to an attractive risk-return profile. The successful adoption of new financial instruments that introduce a strong link between investment returns and resilience benefits could further help uptake in adaptation investments. There are various ways to assess resilience benefits, including one developed by S&P Global Ratings as part of its Green Evaluation methodology.

This report describes: ‘resilience benefits’, how they can be quantified, the difficulties and value of this quantification; the current Adaptation Gap; the economics of adaptation to a sea level rise; barriers to adaptation and roadblocks that adaptation projects may face; and the need for private financing. A summary of the key sections of the report is provided below. See the full text for multiple examples and context.

*Download the full report from the right-hand column.

Key findings

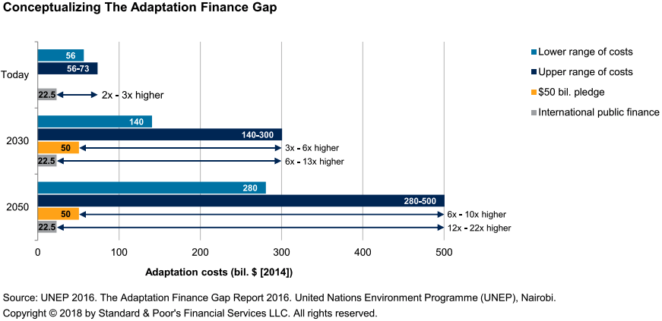

- Adaptation financing needs to substantially increase to address the higher impact of extreme weather to society due to climate change.

- Adaptation projects are typically cost effective and bring wide range of resilience benefits.

- To demonstrate the value of resilience benefits to various stakeholders we consider that it is important to quantify those benefits based on a robust modeling framework.

- We expect that due to the large size of the adaptation gap and constrained public finances, private investment will need to make a considerable contribution to adaptation financing.

Resilience benefits (abridged)

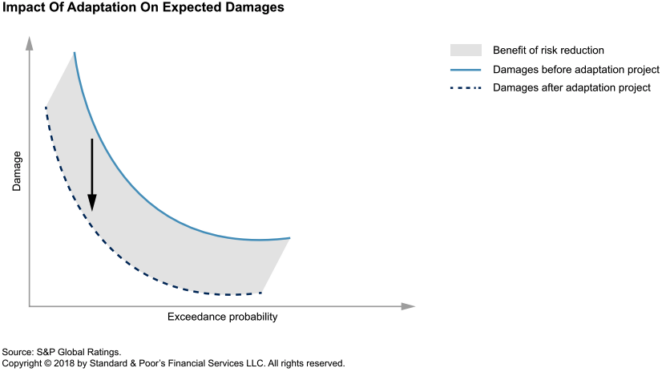

Adaptation in many cases is cost effective, that is, the benefits substantially exceed the investment. The most obvious benefit is reducing the possibility and extent of physical damage from extreme weather events. Another important benefit arises from minimizing the economic disruption following the event. Reducing damage and disruption is likely to lead to further social and ecological benefits. There could also be considerable secondary financial benefits from improvements in resilience. They may promote economic development in an area adequately protected against extreme weather events that formerly wasn’t and lead to reduced insurance costs drop in the protected area.

The nature of resilience benefits changes depending on the local community. For example, given the low asset values in poorer areas, the value of the adaptation may be significantly understated if only physical damage is taken into account. For them, the much larger benefit is likely to be the avoidance of critical disruption to their livelihoods.

Quantifying the benefit

While the existence of different types of benefits of adaptation is often well appreciated, quantifying the expected benefits is usually difficult. This requires models to capture the variety of benefits across weather events of different magnitude and over a long projection period, for which detailed historical damage and exposure data are needed. In addition, such models need to take into account long-term climate scenarios, incorporating projections of how climate might develop and how exposure to the resulting risks might change because of growth in assets and population.

Climate change is expected to increase the overall severity and frequency of extreme weather events. However, there is uncertainty on the precise change in different regions. There is also uncertainty about growth of exposure in high-risk areas, in particular regarding asset values and population.

When quantifying the benefit, it is important to consider all costs and potential negative impacts as well. In particular, any increased damages to other areas as a result of the project need to be taken into account. It should also be noted that all adaptation infrastructure requires regular maintenance to operate as intended. The associated costs also need to be reflected in the quantification to determine the total overall net benefit.

Difficulties in the quantification

While there are well-established methods and models to calculate avoided property damage, economic and social benefits are harder to evaluate because of their wider systemic impact. While tools are being developed to address these modeling gaps, quantifying these aspects may remain challenging for a while. Nevertheless, even if it is not possible for them to be fully quantified, economic and social benefits should be sufficiently highlighted to communicate the wider benefit of the adaptation project.

Calculating the benefit of adaptation projects often takes place amid considerable data, assumptions, and modeling challenges. These challenges may introduce a material level of model uncertainty, which could overestimate or underestimate the overall level of the benefit. This is why disclosing the sensitivities of the value of the benefits to key assumptions is important in understanding the degree of uncertainty. Flexible investments may be a useful way to deal with uncertainties regarding the precise impact of climate change, but they often increase the overall cost of the project.

Value of quantification

The quantification of all of the various impacts of adaptation is important to demonstrate the value of the investment and avoid suboptimal adaptation. In particular, demonstrating a strong resilience benefit is likely to attract more private investors.

Given the difficulties and modeling uncertainties in calculating the resilience benefit, it is important to adopt a sufficiently robust modeling framework. That framework and key assumptions–exposure growth rates, assumed global warming, and discount rates, for example–should be disclosed along with the results. This should be complemented by a discussion of inherent modeling uncertainties illustrated through, for example, sensitivities.

It is true that the return of investments is not directly linked to the expected resilience benefit of the investment. However, in many cases adaptation investments may indirectly help returns.

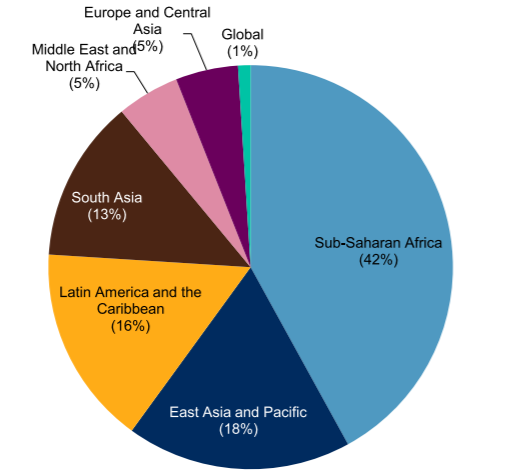

The Adaptation Gap

The adaptation gap is not just an issue for developing countries. Even though developed countries are more resilient to extreme weather events, many of them will need significant adaptation investments to prepare them for the potential impact of climate change.

Adaptation barriers and roadblocks (abridged)

We consider the main factors causing low level of investment in adaptation to be the large sums involved and difficulties in demonstrating the value of adaptation to stakeholders. This makes it difficult to convince decision-makers to prioritize such projects relative to other development needs, especially when benefits may emerge only during an extreme weather event that may happen many years in the future.

Another important barrier for adaptation investments, in contrast to mitigation projects, is the difficulty of monetizing the benefits in the form of clear cash flow streams. It is hard to estimate the specific benefit to every individual family or business in the area.

Other challenges include the complex approval processes involved in attaining funding, social acceptance of projects, and the lack of scientific certainty of the precise impact of climate change on extreme weather events and thus the design of infrastructure (see full text for discussion).

Suggested citation

Petkov, M., Wilkins, M., Delpuech, C-M., and Karusisi, O.J., 2018. Plugging The Climate Adaptation Gap With High Resilience Benefit Investments. S&P Global Ratings.

Further reading

- Towards a more effective, efficient and fair climate finance regime

- Will Private Finance Support Climate Change Adaptation in Developing Countries? Historical Investment Patterns as a Window on Future Private Climate Finance. Working Paper by Aaron Atteridge.

- Footing the bill: What is Sweden’s ‘fair share’ of global climate finance? Report by Clarisse Kehler Siebert.

- Three key private finance initiatives for financing a 1.5°C target

- Engaging the private sector in financing adaptation to climate change: Learning from practice

(0) Comments

There is no content