Engaging the private sector in financing adaptation to climate change: Learning from practice

Introduction

This paper* draws on the experience of the Action on Climate Today (ACT) programme, a five-year initiative that works closely with governments in South Asia to develop strategies to build resilience to the impact of climate change, as well as global literature on engaging with the private sector to finance adaptation. It outlines projects undertaken in India and Nepal to identify lessons learnt and key enablers with regard to private sector engagement in adaptation. The private sector is envisaged as a broad and non-homogenous group; and, in this paper, private sector engagement refers to engaging with businesses from the real economy as well as private financiers – including banks, insurance companies and asset managers – to understand physical climate risks to businesses and investments, to unlock finance for private sector resilience.

The rationale for engaging with the private sector is two-fold: on the one hand, the private sector can support governments facing constrained public budgets and rising costs of managing climate change to achieve global climate resilience by leveraging the ingenuity, skills and financial resources of businesses and the larger financial sector. On the other hand, the private sector itself is gradually becoming aware of the physical risks and opportunities arising from a changing climate, and there is nascent awareness of the measures it can take to assess and disclose risk and maintain the profitability of its businesses

*Download the full paper from the right-hand column.

Drivers for the private sector investing in climate change adaptation

On the risk side of the equation, several elements threaten companies’ operations, which eventually affect their financial performance, in turn having an impact on financiers’ lending and investing activities. This provides a rationale for both types of private sector actors to identify and address such risks through the implementation of adaptation measures.

Climate change also presents opportunities to the private sector, to capitalise on markets that may potentially expand, shift or newly emerge. However, identifying these opportunities does not imply that a changing climate should be regarded as a positive development. Opportunities arise from the identification, by companies in the real economy and private financiers, of their customers’ changing needs – through adaptation and resilience-building.

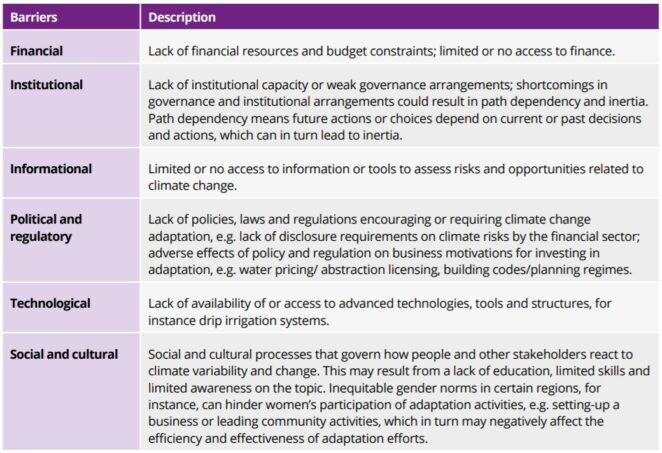

Barriers for the private sector investing in climate change adaptation

There remain barriersto the private sector addressing climate risks and responding to the changing needs of customers as they adapt and build resilience (see table below).

Enabling Factors for the private sector investing in climate change adaptation

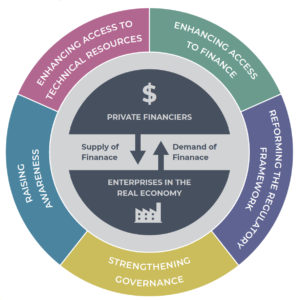

Aligned with these multiple drivers and barriers, several factors can play a critical role in creating an enabling environment for private sector adaptation:

- Raising awareness of the private sector on climate-related risks and associated opportunities, through documentation and dissemination of the business case for climate change adaptation.

- Enhancing access to technical resources for the private sector to have the necessary capacity and expertise to address climate risks and seize opportunities by investing in climate change adaptation.

- Enhancing access to finance to improve the risk– reward profile of private sector investment in climate change adaptation.

- Reforming the regulatory framework to ensure policies, laws, and regulations create an enabling environment for private sector investment in adaptation.

- Strengthening governance by bringing together private, public and civil society actors to mainstream climate change adaptation in their decision-making processes and develop partnerships and collaborations.

Lessons Learnt

The paper identifies a number of success factors from ACT’s interventions:

- Showcasing the impacts of recent and local extreme weather and climate events as an entrypoint to spur engagement with the private sector.

- Speaking the right language by framing climate change around profit and loss, revenues and market share, rather than using a sole environmental perspective, when speaking with the private sector.

- Engaging the private sector in the development and implementation of adaptation policies and plans at an early stage to secure their buy-in.

- Promoting dialogue and building a shared vision between the public and the private sector to encourage them to work hand-in-hand with the government.

- Having access to the right network, expertise and resources to support private sector engagement in adaptation.

Recommendations

Based on these lessons learnt, this paper concludes by identifying a set of cross-cutting recommendations from ACT’s work to engage companies and financial institutions:

- Construct a foundation of narratives, using the private sector’s experience with a recent and local extreme climate event as a starting point and applying language tailored to businesses for them to relate to these events’ impacts on their activities.

- Build a shared vision between the public and private sector by identifying overlaps between the government’s priorities and private sector interests.

- Build the capacity of private champions by providing them with decision support tools to help them understand and assess risks and opportunities and/or identify potential adaptation measures.

- Bridge the gap between the demand and the supply of private finance by bringing together corporations that require lending to invest in the real economy and those that can provide finance (including large corporates, commercial banks, private financiers, the public sector and national/ international climate funds).

- Allow adequate time and resources for shaping governance and regulatory frameworks to provide an enabling environment for private sector investment in climate change adaptation and improve the risk–reward profile of these investments.

Suggested citation

Fayolle, V., Fouvet, C., Soundarajan, V., Nath, V., Acharya, S., Gupta, N., Petrarulo, R., 2019. Engaging the private sector in financing adaptation to climate change: Learning from practice. ACT.

Further reading

- Financing from the Ground Up – Experiences in Adaptation Finance from Southeast Asia

- Lender’s Guide for considering Climate Risk in Infrastructure Investments

- Business case for the Bangladeshi private sector to invest in climate change and access international climate finance

- Three key private finance initiatives for financing a 1.5°C target

(0) Comments

There is no content