Climate-resilient Finance and Investment: Framing Paper

Summary

Adaptation to climate change is increasingly urgent and a vital part of efforts to achieve the sustainable development goals. Building more climate-resilient economies and societies will require scaling up the billions of dollars for adaptation. The UNFCCC’s Standing Committee on Finance identified a need for USD 34.1 billion of global public finance for adaptation in 2017-18. Under article 2.1c of the Paris Agreement which is usually referred to asaligning finance with adaptation and resilience goals,“finance flows [must be] consistent with a pathway towards low greenhouse gas emissions and climate-resilient development. However, his goal has yet to be operationalised.

This paper aims to contribute to the process of defining, measuring and – ultimately – increasing the proportion of finance flows that are aligned with climate resilience. This paper is intended to contribute to discussions in this area. This paper focusses on aligning financial flows with resilience and adaptation goals while noting the unique challenges faced for financing adaptation in least developed countries and Small Island developing states.

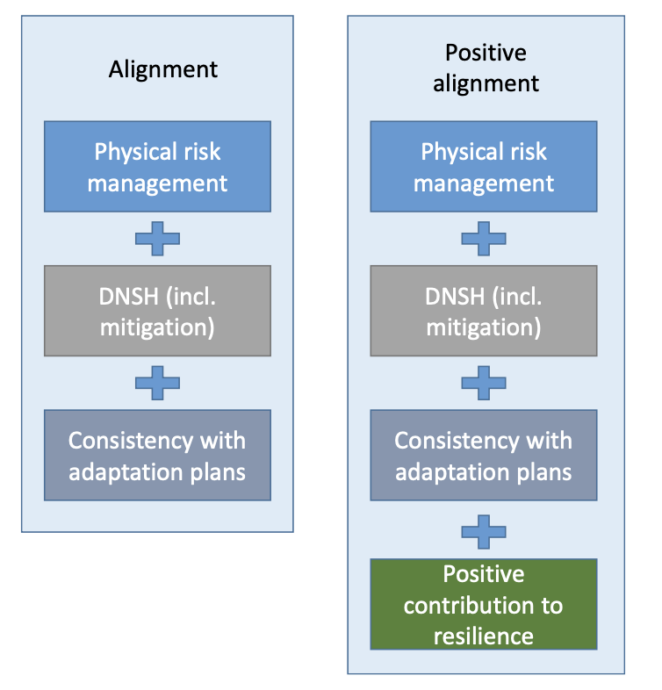

It proposes the following principles for climate resilience aligned finance:

- Physical risk management: the physical risks from climate change (such as drought or heatwaves) should be identified and managed based on forward-looking analysis and considering the intersection of hazard, exposure and vulnerability

- Do No Significant Harm: the management of risks should be done in a way that does not increase the risk faced by others (e.g. by increasing downstream flood risk or damaging biodiversity)

- Alignment with adaptation strategies and objectives: the investment should be consistent with relevant adaptation plans or strategies, such as NAPs

This weADAPT article is an abridged version of the original text, which can be downloaded from the right-hand column. Please access the original text for more detail, research purposes, full references, or to quote text.

Key messages

Below, the key messages of the framing paper are outlined. Please refer to the full paper to explore these in more detail.

Aligning financial flows with resilience and adaptation goals:

Physical risk management is a necessary and important element for climate resilience aligned finance. The improved quantification, pricing and management of physical climate risks by financial institutions has the potential to contribute to enhanced societal resilience, not just through ensuring the resilience of the financial system to climate change itself, but also by creating price signals that influence behaviour in the wider economy.

However, improvements in physical climate risk management may not necessarily lead to better adaptation outcomes, particularly if they lead to measures that increase the risks faced by others, such as the construction of coastal defences that increase the vulnerability of others.

Alignment takes a broader perspective: it looks at whether finance flows are materially supporting the policy goal of helping societies to adapt to the impacts of climate change, consistent with the approach outlined in article 2.1b and article 7 of the Paris Agreement. Alignment takes a longer-term, social perspective while risk management tends to focus on the organisational perspective. Indeed, financial risk management without adaptation alignment risks drawing capital away from the most at risk communities and lead to maladaptation.

In summary, there is a clear trajectory towards greater disclosure and management of physical climate risks, driven by a combination of regulatory reforms and market pressure. The challenge is to ensure that this makes a genuine contribution to the goal of making people better able to manage the risks posed by a changing climate.

The financial sector and alignment to climate resilience:

This section outlines developments in the financial sector relevant to alignment to climate change adaptation and resilience, including the drive to improve disclosure and management of physical climate-related risks and the development of frameworks for alignment.

Financial institutions are now beginning to integrate physical climate risks into financial decision making, albeit the focus still lags behind climate-related transition risks. This progress has been driven by multiple factors:

- Growing awareness of the risks posed by climate change

- Disclosure of physical risk

- Investor expectations

- Financial regulation

- Public-private fora

In summary, improved quantification, pricing and management of physical climate risks by FIs has the potential to contribute to enhanced societal resilience, not just through ensuring the resilience of the financial system to climate change itself, but also by better reflecting price signals that influence behaviour in the wider economy.

Refer to the full paper to explore this chapter (p.15) in more detail, including the criteria for assessing what counts as adaptation-aligned finance; and the principles that could be used to identify climate resilience aligned finance and assets within a portfolio.

Towards measuring adaptation alignment:

Measuring alignment to adaptation and resilience goals, and disclosing that information where appropriate, could yield significant benefits for society, financial institutions and investors, synonymous with those for alignment to mitigation goals:

- Enable investors and lenders to assess the position of companies and portfolios in relation to adaptation and resilience goals at global, national and local levels, provided that there is clarity about the use of proceeds

- Increase the ability of financial institutions to effectively allocate capital in ways that support resilience and adaptation goals

- Increase the ability of financial institutions to track their own contributions to resilience and adaptation goals

- Create opportunities to derive value (reputational, commercial positioning, cost of capital benefits) through increasing alignment with the Paris goals

- Reinforce incentives for physical risk management across the private sector, and help to integrate and price risk is a comprehensive way.

Together these should help – along with the efforts to resolve market failures – to drive more financing into climate resilience aligned activities and away from activities that undermine resilience and lead to maladaptation.

Discover the challenges in measuring alignment with adaptation, and the proposed approach and metrics to assess alignment more effectively in the full paper (p.28).

Initial directions for strengthening the enabling environment for adaptation-aligned finance:

The public sector can create the right enabling environment for private finance to be aligned with adaptation and resilience goals, which is one component of the broader role in supporting societal adaptation.

Policies and interventions that support alignment can be categorised into four areas, some of which target financial institutions and investment directly, while others influence corporates in sectors most relevant to adaptation and resilience:

- Setting the overarching framework for adaptation-aligned finance by FIs and mandating relevant disclosures by FIs, investors and investees/corporates.

- Providing public goods for both FIs, investors and investees/corporates, including data, knowledge and guidance.

- A range of regulation and incentives, including those that directly target financial institutions and those that target investees/corporates.

- A range of wider public policy and expenditure linked to national resilience and adaptation planning, the government’s own investment in, for example, public infrastructure, the role of the Central Bank, and government procurement.

Refer to the full paper (p.33) to explore these 4 areas in more detail, and to learn how the Glasgow city region has used public policy for adaptation alignment.

Recommendations and Future Work

There are inherent uncertainties when predicting the likely impacts of climate change, combined with significant gaps in the availability of data and modelling of impacts. As such, these principles should be applied in a way that is robust to uncertainty, by favouring approaches that are flexible and perform well across a range of different possible climate futures. Regular monitoring, evaluation and response measures can help to achieve this.

Public policy has an essential role to play in mobilising and aligning finance to manage the risks from climate change, ultimately increasing flows of climate resilience aligned finance. There are a broad range of policy levers — including provision of data, procurement policies, and regulation — that can work together to increase flows of adaptation aligned finance.

A framework is needed to define, measure and – ultimately – increase the alignment of investments with adaptation and resilience goals, consistent with Article 2.1c of the Paris Agreement. Moving forward on this agenda will require further work to define climate resilience aligned finance, measure current trends and – ultimately – use the right policy tools and financing instruments to mobilise additional resources.

Explore p. 38 of the paper to view proposed steps in moving forward in developing an assessment framework that is robust, measurable and accepted by key stakeholders within the financial system; with work starting in 2022 and potential work for 2023-24.

Suggested Citation:

Mullan, M. and N. Ranger (2022), “Climate-resilient finance and investment: Framing paper”,OECD Environment Working Papers, No. 196, OECD Publishing, Paris,https://doi.org/10.1787/223ad3b9-en.

(0) Comments

There is no content